Registered Plans

Save for any stage of life with a plan that's right for you.

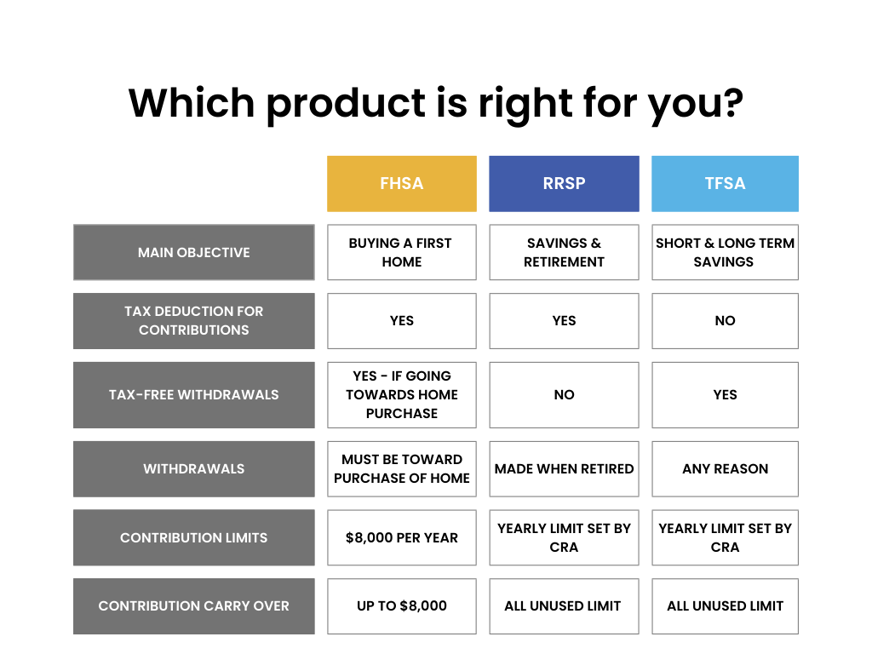

Registered Plans from TCU Financial Group allow you to save for various stages of life. Whether you are saving for your first home, a vehicle purchase, retirement, or just want savings for an emergency, there is a registered product that is right for you. Compare your options below and book an appointment with one of our experts to start saving with a Registered Plan today!

Credit Union Deposit Guarantee Corporation (CUDGC)

Deposits held in Saskatchewan credit unions are fully guaranteed. There is no limit to the size of the deposit covered by the guarantee - whether $1 to $1,000,000 or more, all deposits are fully guaranteed.

Registered Retirement Savings Plan (RRSP)

Retire on your terms with an RRSP.

Registered Retirement Savings Plan (RRSP) is designed to help you retire comfortably and on your own terms. Enjoy life the way that you want through retirement by starting to save with an RRSP today.

For more in depth information on Registered Retirement Savings Plans, please read here.

- No minimum age to contribute

- Choose a term between 1-5 years

- Contributions to an RRSP are tax deductible

- Funds in an RRSP remain tax sheltered until withdrawn

Tax-Free Savings Account (TFSA)

Save your money tax-free with a TFSA.

A Tax-Free Savings Account (TFSA) is designed for you to set money aside tax-free throughout your lifetime. Save for your short and long term goals such as a vacation, a vehicle purchase, or retirement with a TFSA.

For more in depth information on Tax-Free Savings Accounts, please read here.

- Minimum age of 18 years old to contribute

- Choose a term between 1-5 years

- Contributions made to a TFSA are not tax deductible

- Contributions and Interest earned grow tax-free and no tax is paid on withdrawals

First Home Savings Account (FHSA)

Make your homeownership goal a reality with an FHSA.

The First Home Savings Account (FHSA) is a registered plan allowing you as a prospective first-time home buyer to save for your first home tax free.

Any savings not used to purchase a qualifying home can be transferred tax-free into a Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF) or can be withdrawn on a taxable basis.

For more in depth information on First Home Savings Accounts, please read here.

- Minimum age of 18 years old to contribute

- Must be a first-time home buyer

- Lifetime contribution limit of $40,000

- Annual contribution limit of $8,000

- Can carry forward unused portions of your annual limits up to $8,000 per year

Ready to apply or have questions?

Investment Calculators

Our easy-to-use calculators can help you map out your retirement plan, set a savings budget, determine your retirement income and more.

*Rates subject to change.

Let’s talk about saving for your future

Our Member Experience Team is here to help you understand your options and make the decision that is best for you. We take a solution-based approach to making the most out of your financial future.

If you have questions about saving for the future, we have answers.

Make the most out of your credit union membership with these solutions.

Are you a sophisticated investor who wants to self-invest in stocks, ETFs, bonds or mutual funds? We have partnered with Canada’s #1 online trading platform Qtrade to provide our members additional investment opportunities.*

Do you want to invest your money into the market but aren’t sure where to begin? Qtrade Guided Portfolios makes investing easy with a fully online digital advice service offering a professionally managed, low-cost portfolio to match your personal goals.*

Every home purchase journey is unique. We approach home financing as a complete solution that ensures you get the home of your dreams and a mortgage that matches your expectations.

Search

Search

https://online.tcufinancialgroup.com/

https://online.tcufinancialgroup.com/